2024’s housing market off to a ‘disconcerting start’

Tompkins County’s worsening housing shortage could be turned around if local lawmakers were to implement initiatives to increase median-income workforce housing — this was the takeaway of a recent presentation by the Ithaca Board of Realtors. But, said Brent Katzmann, head of the Ithaca Board of Realtors Government Affairs Committee, the problem is still increasing in severity year after year, with 2024 looking no better.

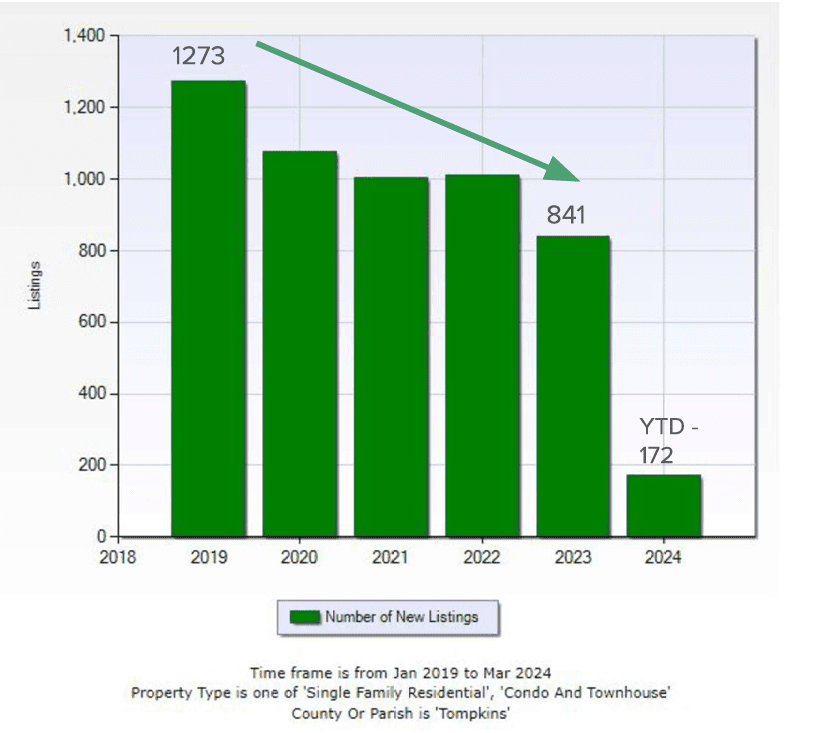

“This year is off to a sort of disconcerting start,” Katzmann said. “Already in 2024, the number of new listings that have come on [the market] are down 14% from last year’s historic low. We aren’t seeing much turnaround yet in existing housing stock returning to market.”

One year ago, some of the biggest market concerns for Tompkins County were a lack of resale inventory, expanded Federal Emergency Management Agency (FEMA) flood zones and rising insurance costs, the high cost of new home development and construction, a need for expanded municipal infrastructure servicing vacant land, zoning restrictions impacting the creation of single-family and in-fill housing, growing homelessness, New York state barriers to condominium development and a shortage of options for seniors, Katzmann said to begin his presentation, titled “Today’s Local Real Estate Market” at the May 3 meeting of the Housing and Economic Development Committee of the Tompkins County Legislature.

In addition, current housing creation focuses on well-resourced or low-income housing, rather than housing for the “missing middle” or “workforce housing,” Katzmann said.

NIMBYism was “alive and well,” Katzmann added, describing the acronym for “not in my back yard” as local citizens who are concerned about changes to the character of their neighborhood as the result of added development.

“NIMBYism seemed to be often influencing the decisions made by municipalities about what housing would be allowed,” he said.

Transportation limitations that disproportionately impact medium- and low-income households are also a concern.

Since the time of the Board of Realtors’ presentation a year ago, there has been some movement in the marketplace, Katzmann said. The opening of Library Place senior apartments in Ithaca should by most accounts free up some of the homes previously occupied by its tenants and bring those homes back into the marketplace, Katzmann said.

He mentioned that last year saw the launch of the New York state “Plus One” pilot program to develop accessory dwelling units, which would give owners of a single-family home the opportunity to build a small-footprint additional dwelling unit in the form of a carriage house or an attached small dwelling unit.

“This is a program that we’ve actually been very interested in seeing more of,” Katzmann said. “INHS [Ithaca Neighborhood Housing Services] was awarded the opportunity to try to see what they could do with this initial funding. There have been some difficulties in making real progress because of … the requirements for how the state defines an accessory dwelling unit versus how the local municipality does, but mostly [the difficulties] had to do with figuring out the cost and how much the program could really afford. But they are still working on it, hoping to get a few of those [accessory dwelling units] built here within the coming months.”

Additional positive signs of movement within the housing market include new city of Ithaca short-term rental regulations that aim to return single-family properties to long-term rental or owner-occupied housing, Katzmann said. Ithaca Common Council approved the regulations in a vote held May 1.

In addition, the Community Housing Development Fund continues to award grants to income-qualified projects, Katzmann said, adding that INHS continues to broaden its offerings across the county, including the manufactured housing community, Compass, and Village Grove apartments, both of which are in Trumansburg, and others.

“Also, I think good news is that the Pro-Housing Community initiative of New York has managed to get Groton to sign on, and the city of Ithaca and the town of Dryden have both submitted letters of intent to participate,” Katzmann said.

The New York State Pro-Housing Community Program provides a certification program for local governments that are taking action to support housing growth to address the housing shortage throughout the state. The program will certify participating communities, and those communities will receive a preference in the scoring/evaluation of certain discretionary funding grants.

“These are additional fundings available to communities to help support housing growth by the communities taking a pledge to develop housing, particularly for the workforce and affordable marketplace,” Katzmann said.

Still, as Katzmann noted on one of his PowerPoint slides, the more things change, the more they stay the same.

“There has been progress, and we all know the severity of the housing shortage here and the concerns we all have about continuing to make advancement and making homes available for people who live and work here,” he said. And yet, new residential listings continue to decline, year after year.

Statistics for this year build on trends from last year.

In 2023, there were 841 properties made available to purchase in Tompkins County, compared to 1,273 prior to the pandemic.

When a property does go up for sale, buyers have to participate quickly, Katzmann said. Homes are going on contract and moving toward closing in under 23 days on average.

This competition has led to an increase in average sale prices of 31% since the start of the pandemic.

This has resulted in increases in sales prices and a decline in properties available for purchase in surrounding counties, as well.

“We have got people who want to live in Tompkins County who have not been able to find anything, so they search a little farther afield, where they can find something they may be able to afford,” Katzmann said.

So, what does that mean to affordability locally?

“Obviously it’s plummeted,” Katzmann said. Simply put, Tompkins County residents making a median income cannot afford an area median-value home. The median inflation-adjusted income in Tompkins County has largely been flat since 2019. Based on a community survey, it is estimated that the average area median income will rise to just below $70,000 this year, which is about three-quarters of a percent increase over 2023.

Using a definition of “workforce housing” that defines the term as houses that people making 60% to 120% of the area median income could reasonably afford, workforce housing in Tompkins County are houses that fall within the price range of $130,000 to $350,000. Sales of houses in that range have declined 40% between 2021 and 2024.

“This is largely due to price escalation,” Katz said. “Houses that were once $200,000 are now $250,000 or $300,000, and it just continues to go up the ladder, if you will.”

With the nearly 20% increase in assessed property values in the county overall this year, the assessed value is now growing faster than the actual property value in terms of sale prices.

With only one or two tax parcels added within the last few years, according to Katz, the taxpayer burden has been steadily going up as school districts across the county increase their budgetary requirements faster than property values are increasing.

“It seems that this significant assessed value increase sort of works up the community, and there have been a lot of meetings, a lot of conversations, a lot of people showing up now for school board meetings,” Katz said. He mentioned that the Ithaca City School District Board of Education at its last meeting agreed not to pursue its interest in continuing with the same tax rate as last year but would instead be adjusting its budgetary demand.

“We applaud the movement in that direction,” Katz said. But even with the newly adjusted Ithaca City School District tax rate, the average homeowner living within the district will still see on average a 14.7% percent increase in their tax bill over 2023, according to Katz, who said,“It’s still well ahead of what incomes are doing and what values are doing.”

Short-term implications include short-term rental restrictions, the support of the Housing Access Voucher Program, holding to property tax caps and support of the First Time Homebuyer Savings Program.

Actions that would help improve the situation in the long term, said Katz, include increasing the adoption of the Pro-Housing Community Program in Tompkins County, zoning changes to increase density, infrastructure investment and/or developer incentives for middle-market, owner-occupied housing and property tax reform.

Katz suggested that local officials ask themselves and their community members what they think is a reasonable approach to rethinking density zoning in their community. Who should be involved? How long should it take, and how can Board of Realtors members contribute?

During the question-and-answer period following Katz’s presentation, Mike Sigler (R-Lansing) asked, “You had mentioned zoning to increase density. What do you mean by density? Just density within the city, or do you mean density within the suburbs?”

“I think that’s a good question. Density obviously meaning the number of dwelling units per unit of land,” Katz said, adding that an increase in density could be beneficial in a number of circumstances.

“I think the city certainly has some opportunity to do that, particularly on the accessory dwelling unit front, because they are small lots to begin with. But the town of Ithaca, which tends to have larger parcels and has historically been very restrictive on second dwelling units and are very specific on where they’ll allow it and how they’ll allow it to happen, [could reconsider density],” Katz said.

He added that moving away from the low-to-medium density model of planning “to allow folks to create both additional income on their property but also to create more homes seems prudent.”

Sarah Wisdorf, executive director the Ithaca Board of Realtors, added that for neighborhoods where historically triplexes or fourplexes would not have been allowed, municipalities could change the zoning to allow for easier development of multifamily units.

“Just being open to thinking about different utilizations of what historically would have been in the 1950s single-family [homes], big yards, big garages. Those kinds of things,” Wisdorf said.

“But isn’t that kind of what people are looking for?” asked Sigler. “It seems to me that when people are moving here, they’re looking for a single-family home, maybe not with three acres but certainly with a yard, and that seems to be what’s kind of missing from the market. I mean, that’s what’s driving the single-family home assessments through the roof.”

“There is so much demand right now,” said Katz in his reply to Sigler. “And still, you know, we are land rich and housing poor, right?”

Katz said that he believes there is a way to further two kinds of development.

“I wouldn’t say that it’s an either-or,” Katz said. “I don’t think those are incompatible, to do both cluster development for those who don’t want big yards to maintain … but to also allow for those who have a larger parcel to have it.”