Don’t let the Presidential election scare you out of the stock market

With the Presidential election just one week away, I want to deliver an important message to Tompkins Weekly readers: don’t let the outcome of the election impact how you invest for your future.

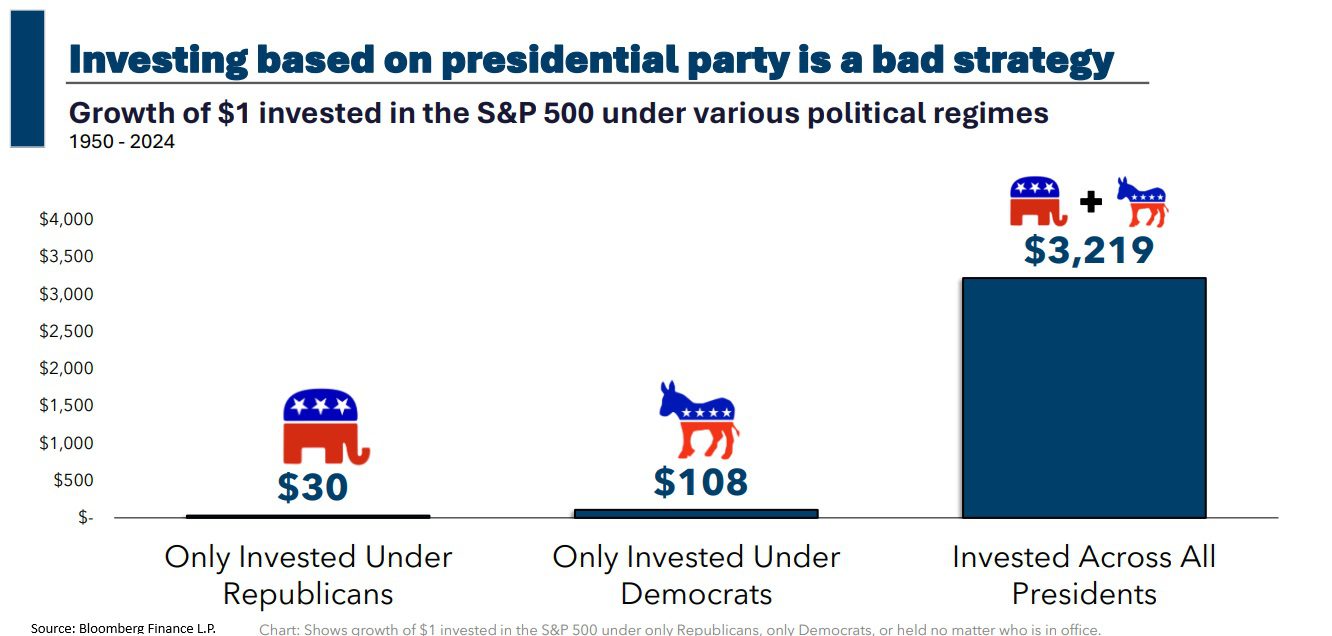

Making investment decisions based on politics is a surefire way to lose money in the stock market or miss out on significant gains.

With the upcoming election essentially a coin flip, uncertainty is high. It can be difficult to invest the bulk of your life savings when the future is uncertain, but water is wet and the sky is blue.

Ultimately, you’ve got to risk it for the biscuit. Because without risk, there would be no reward. And without reward, there would be no point in investing. The key is to take measured risks through a diversified investment portfolio that matches your time horizon and risk tolerance.

Savvy investors view the uncertainty surrounding the Presidential election as an opportunity, and so should you. Here’s why.

The President has less control over the economy than you think

It grinds my gears when a sitting President, Democrat or Republican, takes credit for record highs in the stock market.

Corporate profits drive the stock market over the long term, and millions of hardworking employees and consumers, not the President, drive corporate earnings growth.

There are a record 159 million employed Americans. So, who do you think has more influence over the direction of the economy and, therefore, the stock market?

My money is on the American people.

Because regardless of who is inaugurated as the 47th President of the United States on January 20, 159 million Americans are going to roll out of bed, fix a cup of coffee, and get to work to make this country better than it was the day before.

Markets have performed well under both parties

Since 1950, the S&P 500 has delivered an average annual return of 12% under Democratic Presidents and 8% under Republican Presidents. While 12% is higher than 8%, to benefit from compound interest, you must stay invested for the long term.

“The first rule of compounding: Never interrupt it unnecessarily,” the late Charlie Munger said.

I’m sure he would agree that changing your investment strategy because of who wins the Presidential election would count as “unnecessarily.”

Additionally, the President doesn’t make policy in a vacuum. The Federal Reserve, global economic forces, and technological advancements are critical in shaping the economic environment and are beyond the White House’s control.

A divided Congress has historically been bullish for stocks

If your preferred candidate doesn’t win the Presidential election next week, remember that a potentially divided Congress will be a powerful check on their power.

And that check on power is worth a lot to investors, as it limits the President’s ability to deliver wide-sweeping changes that could influence the broader economy for better or worse.

Since 1950, the S&P 500 has delivered average annual returns of about 16% when Democrats and Republicans each controlled a part of Congress, compared to just 8% when Congress was controlled by a single party.

Disastrous examples of mixing politics with investing

To drive home just how devastating investing based on politics can be, let’s look at some examples.

On March 6, 2009, the conservative Wall Street Journal published an article titled: “Obama’s Radicalism Is Killing The Dow.” I’m happy to report that the Dow Jones Industrial Average is alive and well, surging 563% since that article was published.

The stock market has a funny way of making people look foolish.

For example, oil stocks were the worst-performing sector during Donald Trump’s Presidency, while clean energy stocks were the best-performing sector. Meanwhile, clean energy stocks have been the worst-performing sector during President Biden’s term, while oil stocks have been the best-performing sector.

Most people would have guessed the opposite.

Ultimately, politics is emotional. When emotions run high, it’s easy to make impulsive investment decisions based on fear, anger, or optimism. However, successful investing requires a disciplined approach that focuses on fundamentals, not feelings.

Stick to your financial plan!

Don’t change your investment plan because of the outcome of the upcoming election. It rarely works.

And if you don’t already have a financial plan, or if you’re looking for a second opinion, contact Ithaca Wealth Management!

We offer free consultations, have $0 account minimums, and abide by the fiduciary standard. It’s never been easier to hire a financial advisor in Ithaca, NY. We’re here to help!