It’s tax season in Lansing: Here’s what you need to know

Although it’s not usually people’s favorite time of year, tax season has officially started in Lansing.

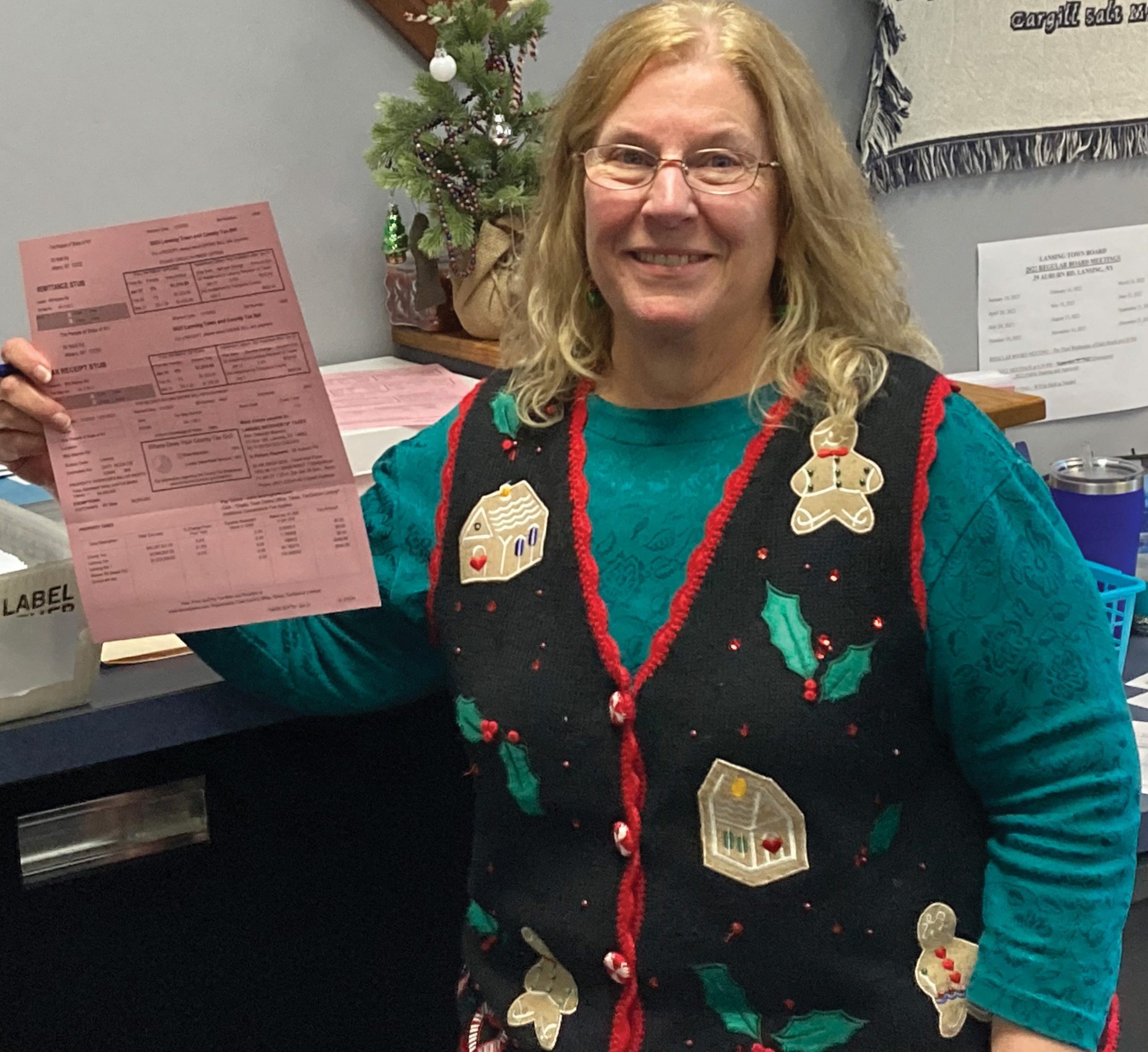

Lansing town clerk Debbie Munson holds up a property tax bill. Photo by Geoff Preston

Last Friday, Dec. 30, Lansing Town Clerk Debbie Munson said the office started mailing residents their property tax bills. She said any resident who doesn’t get a bill by Friday Jan. 6 should call her office at 607-533-4142.

Munson added that if a property owner has a mortgage through a financial institution and has escrow payments set up, the financial institution will receive the bill from the town clerk.

Still, Munson stressed that it is the property owner’s responsibility to ensure that the taxes are paid, even if the bill goes to a financial institution.

“Even if people don’t receive a bill, they are responsible to pay the taxes, whether they pay them on time is their choice,” she said. “Sometimes people call us and say, ‘Well, I never got a bill in the mail.’ We don’t have control over the mail and, by law, it is up to the property owner to make sure that the taxes are paid. Bill or no bill, whether they think the bank is paying it or not, they’re the responsible person.”

Taxes must be paid to the town clerk by Jan. 31 in order to avoid penalties. Starting Feb. 1, a 1% fee will be charged to the base tax amount, with another 1% coming if the payment is made after Feb. 28.

If the payment is made after March 31, it is officially considered late. Multiple years of late payments can result in the property owner losing the property. It also means that the taxpayer would accrue an additional 5% fee to Tompkins County on the base amount, on top of the 2% late-payment penalties.

The office also offers an installment plan, in accordance with New York state law. A first installment can be paid to the town clerk in January, with the remaining amount being paid to Tompkins County by July 3.

Lansing at Large by Geoff Preston

Munson stressed that the easiest way to avoid late payments is to pay in January, but if payments aren’t made going into April for multiple years, the property could be on the line.

Payments can be dropped off directly to the town clerk, where there is a drop-box inside the door of the office on the left-hand side that goes directly into the clerk’s office, which is secured. When dropping off payments, cash or check is accepted.

If the payment is being mailed, it must have an official United States Post Office postmark dated on or before Jan. 31 to avoid a penalty. Property owners can also pay online at www.lansingtown.com by credit or debit card or e-check. There are fees associated with online payments.

Munson said this is one of the busiest times of year for the small office. She spent most of the sleepy week between Christmas and New Year’s Day stuffing roughly 4,900 envelopes full of bright pink tax bills.

She said her warrant, or the amount her office is allowed to collect, is $15,638,702.32. Within that amount, $4,944,071.08 goes to the town of Lansing, while $10,694,631.05 goes to Tompkins County.

Munson said it’s a lot of money, and a lot of responsibility, to keep track of payments and make sure the balance sheet is correct. But, this isn’t her first tax season. Even though the office will be busy, she said the staff is accustomed to all payment types and all kinds of situations.

“It’s a lot of money for a small office to collect; we’re very busy in January,” she said. “We’re kind of used to it. We’re super careful, I can tell you that.”

The town clerk’s office will be open Saturday, Jan. 28 from 8 a.m. to noon to allow for additional tax collection.

Lansing at Large appears every Wednesday in Tompkins Weekly. Email ideas to editorial@VizellaMedia.com.

In brief:

Lansing town office update for January

Lansing Town Hall, located at 29 Auburn Rd., will feature two meetings in January.

There is a regular town board meeting scheduled for Wednesday Jan. 18 at 6:30 p.m. The next morning, the Agriculture and Farmland Protection Committee will meet at 8 a.m., also in the town hall.

The offices were closed Jan. 2 to observe New Year’s Day, and will be closed Monday Jan. 16 to observe Martin Luther King Jr. Day.

The town clerk’s office, which closes at noon Fridays, will be open until 4 p.m. on the last Friday of the month, Jan. 27, for property tax collection.