Legislature approves tentative 2021 budget

On Oct. 29, the Tompkins County Legislature approved a tentative 2021 county budget, advancing the budget-making process to the next stage of a public hearing and later a scheduled vote in mid-November.

The tentative budget is $180 million overall, a drop from the $189 million proposed previously, with an estimated total tax levy of $52,399,459 and a tax rate of $6.21. The taxes on a median-priced home of $200,000 would be $1,242. The proposed tax levy increase is 2.21%, less than half of the 4.97% originally proposed earlier this year. For a full, itemized list of approvals and denials to the 2021 proposed budget, visit https://t.ly/urk4.

County Administrator Jason Molino said that while second-quarter earnings show an improvement in the county’s financial condition since the start of the pandemic, the changes to the proposed budget still account for a possible downturn into the new year.

“The problem is that we have no consistency, no pattern to be able to predict what 2021 is going to be,” Molino said. “You don’t know how the economy is going to respond. We don’t know how jobs or job creation [or] unemployment is going to respond. We don’t know buying power. We don’t know if there’s going to be a resurgence in COVID.”

While 2021 is difficult to predict, the county is using its experience from this year so far to guide decisions for the next fiscal year.

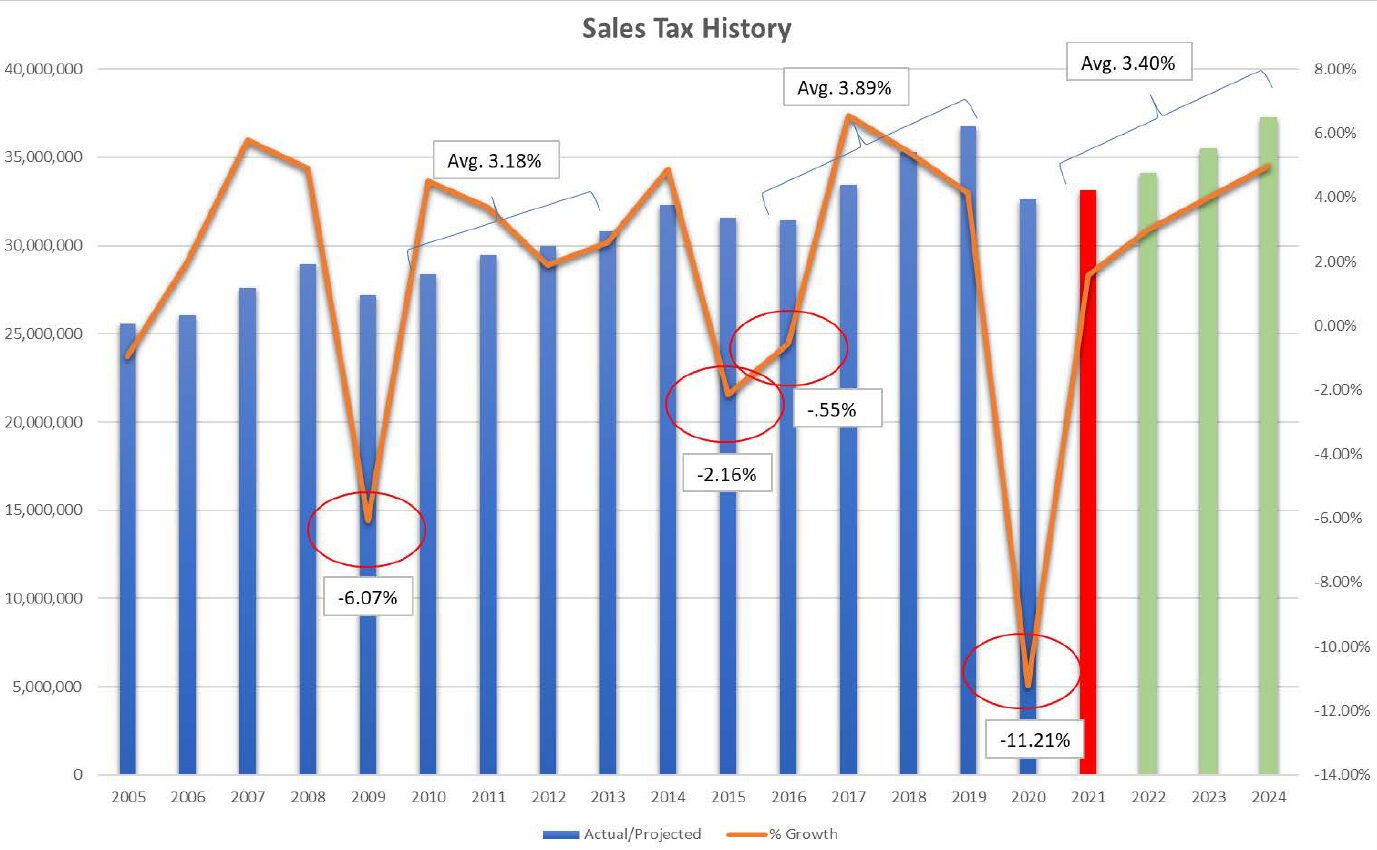

As Tompkins Weekly covered previously, the county’s finances this year have struggled so much largely due to the significant decrease in sales tax revenue.

As of Aug. 31, the county had experienced more than a 15% decrease in sales tax compared to last year, according to a letter Molino sent to legislators Sept. 19.

Gov. Andrew Cuomo announced earlier this year that state aid to municipalities would be cut by 20% without another federal stimulus package, and with the federal government still not issuing that stimulus package, the county has already felt that loss of state aid.

Over the summer, the county took several actions to cut spending and minimize the impact of revenue shortfalls, like a hiring freeze, spending freeze, temporary furloughs of 100 employees, suspension of several capital expenditures, mid-year reductions to supporting agencies, an early retirement incentive and changes in retiree healthcare benefits.

In total, mid-year reductions in spending equaled $5.8 million. With revenue decreases and state aid still uncertain, the total revenue shortfall could exceed $12 million in 2020.

While there is much uncertainty regarding what 2021 looks like, Molino and legislators worked to ensure there are systems in place to deal with a worst-case scenario, mostly around state aid and sales tax — the two largest contributors to how 2021 finances look.

As Legislator Martha Robertson explained, the 2021 budget assumes that the county will continue to experience a decrease in state aid that will not be reimbursed.

“We’re expecting those will turn into permanent cuts,” she said. “If, in fact, there is a federal bill that includes state and local aid, and depending upon how much that is and depending upon how the rules are written, we might get some of that back. Or we might get other unrestricted aid. But we’re not counting on it at all.”

As far as preparing for a sales tax revenue shortfall, Molino said the county has budgeted a $1 million additional contingency.

“Under normal circumstances, we have a $900,000 contingent budget, which is for unintentional, unknown or unexpected expenses or shortfalls of revenue,” Molino said. “When I proposed a budget, I increased it to $1.9 million so we had an extra $1 million of the contingency.”

Another large contributor to the county’s overall recovery is the U.S.’s control over the virus. As Robertson explained, the nation’s handling of the coronavirus and advances by health professionals are the difference between a best-case and worst-case scenario next year.

“If there’s a great vaccine that everybody feels confident in and they get that in February, then we could see a quick and pretty good rebound for most of the year,” Robertson said. “We’re also hearing that it might not be till the end of 2021 before most Americans have a vaccine. So, those are the extremes that make a big difference which way that goes.”

Outside of these areas, the county is also working to ensure that residents won’t see a drop in services provided by county government groups, nonprofits and other organizations, which have had to present budgets to the Legislature that reflect at least a 12% decrease in spending.

“One of our challenges is to reimagine how we deliver services under these circumstances,” Molino said. “It’s likely that we’re going to be in pandemic mode probably for most of 2021, if not longer. So, how we’ve been operating to be able to reach our customers or reach our clients or reach our residents and citizens has been changed in many ways. And some of it’s been changed for the better.”

Molino and Robertson agreed that, despite all the challenges and uncertainty caused by the pandemic, the county is well-poised to fare better than other areas into the new year.

“We are in a relatively good position compared to other communities because we have, for years, taken a really balanced approach, to underestimating how much revenue we’ll get and then being pleasantly surprised, to putting in place preventive programs like alternatives to incarceration and intensive preventive work with families at risk so the kids don’t end up in foster care,” Robertson said.

Molino shared that sentiment.

“In terms of being positioned well to be able to succeed, I don’t think you can be in a better community right now than Tompkins County,” Molino said. “That’s the bright side of things. We are doing, I think, a better job than most at managing the disease. The public has been very responsive, higher ed has been very responsive, and as a result, we’re starting to see some progress.”

For additional details on the 2021 budget, visit the county’s website at www2.tompkinscountyny.gov/ctyadmin/2021budget.