Local housing market remains active despite tight inventory and rising prices

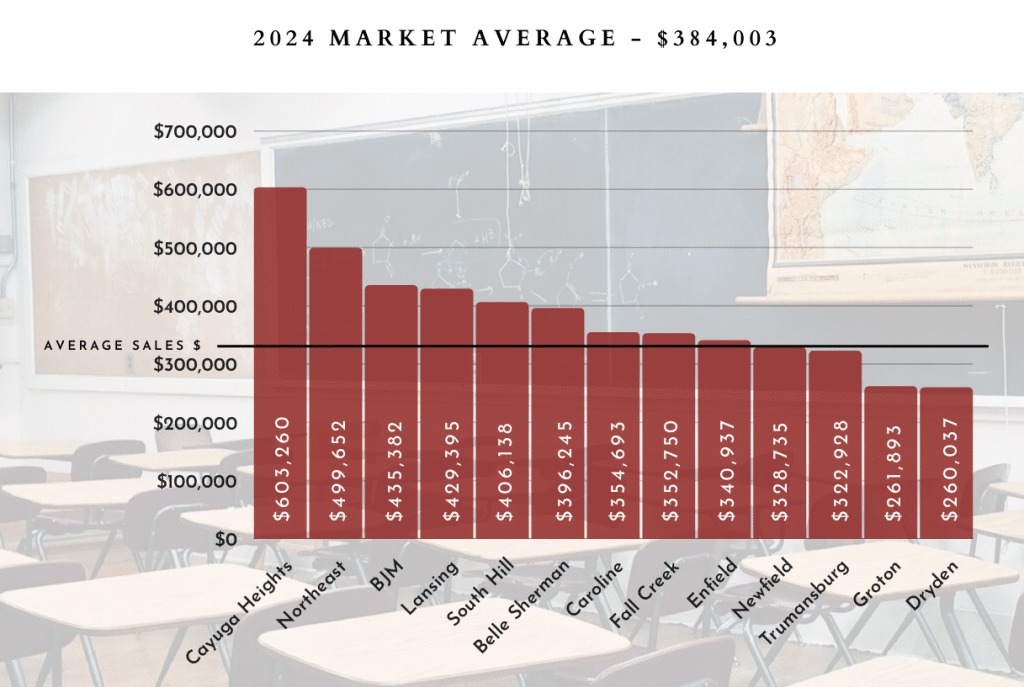

This home on South Street in Dryden is located in the Tompkins County school district with the lowest market average. The average selling price for a home within the Dryden Central School District was about $260,000 in 2024, compared to the county average of $384,000.

Despite challenges, the local spring housing market has been active in Tompkins County, with buyers eager to purchase and slightly more new listings than usual, according to data from Warren Real Estate.

“If the house is priced right, in good to great condition and in the ‘right’ location, it gets multiple offers with minimal or no contingencies or conditions in the offer,” Lindsay Hart, licensed real estate broker with Hart & Homes Real Estate Team at RE/MAX In Motion, said. “Sellers could expect to get list price or slightly under in this market, unless of course, the home or property is in a very desirable location, is in excellent condition, is a property type that is in high demand and is priced appropriately or aggressively. Then it can expect to get multiple offers, probably 10-15% over list price.”

Though the highest number of homes are sold in the second quarter, from April to June, Warren Real Estate reported that sales activity has been spreading later in the year in the past few years. There is no longer really a true “off season.”

However, inventory remains tight. New residential listings in Tompkins County have declined 32% since 2020, dropping from 1,144 in that year to 782 in 2024.

What stood out about 2024 to Richard Patterson, co-manager and licensed associate real estate broker with Howard Hanna Real Estate Services in Ithaca, was the continued relatively high rate of appreciation. “The median sales price of residential property sold through the Ithaca Board of Realtors MLS in Tompkins County increased 10.7% in 2024 over 2023,” he said.

“Interestingly enough, the numbers tell us that 2023 saw more properties sell in Tompkins County than in 2024, and I think that is purely a supply and demand issue,” said Hart.

Tam Warren, Warren Real Estate’s vice president, predicts that this year’s market will likely be very similar to the last four years. This year, the first quarter appears to be holding steady compared to last year’s historic low, with 172 new listings already recorded—just above the 169 listings seen for the full first quarter of 2023.

This graph shows the average sale price for homes in Tompkins County, broken down by school district.

“Because of the active winter market in 2024 into 2025, the market is steady and stable,” Hart said.

At Howard Hanna, year to date, the number of accepted offers has increased 7%, and the dollar volume on those offers has increased 27% for 2025, compared to the same period in 2024, according to Patterson.

“The number of listings taken decreased 10%,” Patterson added. “There continues to be a shortage of inventory.”

This year will be marked by the uncertainty created around the administration of President Donald Trump, said Kate Seaman, New York state licensed real estate broker and team lead at Warren Real Estate.

“The Trump administration is changing our economic outlook, with the cutbacks at Cornell and hiring freeze,” Seaman said. “But the fact of the matter is that prices in our market are continuing to rise, and we’re not seeing prices dropping.”

Data shows that nationwide mortgage rates have held relatively steady over the last 12 months. The national average for a 30-year fixed rate mortgage for the last week of March, 2024, was 6.79%, according to Freddie Mac. It dipped to a 2024 low of 6.08% in October, then went back up the current average rate of 6.67%.

At the same time, in Tompkins County, property values continue to rise.

“We’re trying to teach that to the buyers,” Seaman said. “If you were buying last year, you would have gotten a better deal.”

Homes continue to sell quickly. The average number of days on the market was 23 in 2023, consistent with the prior year. This follows a rapid acceleration at the start of the COVID-19 pandemic, when the average days on market dropped from 51 before the pandemic to 29 in 2021. Multiple offers are common in our market and seem to be the new normal for highly desirable homes that are priced well.

Average residential sales prices have increased across all school districts, with the most expensive being the Cayuga Heights district, which had an average sale price of $603,260 in 2024. The Dryden Central School District had the lowest 2024 market average at $260,037, according to information gathered by Warren Real Estate from a variety of multiple listing services.

In 2024, the Ithaca Board of Realtors Multiple Listing Service (MLS) data showed that in Ithaca the average sale price was $373,700, with 758 listings sold.

In Tompkins County, the average list-to-sell ratio (the final sale price divided by the last list price) in 2024 was 100%, down slightly from 102% in 2023 and 104% in 2022.

The average selling price in Tompkins County was $380,450 last year, according to MLS data.

The market is showing early signs of positive shifts as mortgage rates begin to level off, with a slight increase in the number of houses going on the market, but it has largely remained about the same since the pandemic, Warren said.

“The real estate market has been really spotlighted in the press,” said Warren. “Everyone has been talking about real estate and the market, so I think that people maybe think that it’s worse than it is, but the reality is Tompkins County always experienced a lack of inventory.”

Tompkins County has become increasingly unaffordable for many buyers, she said, driven by a number of key factors, the first being a declining number of homes available for purchase.

Increased mortgage interest rates, higher property and school taxes due to rising assessments and the lack of new housing development — coupled with homeowners holding onto historically low mortgage rates of 2% to 4%, rather than moving into mortgages above 6% — have severely limited the housing supply.

A healthy real estate market will have six months of inventory, and that would be a situation that was neither a buyer’s nor a seller’s market, Warren said. This would mean that it would take about six months to sell all of the homes on the market at their current selling prices.

“Right now, we have one month of inventory, and that makes it a seller’s market,” Warren said. “We’ve always experienced less homes than we have buyers, and the pandemic just accelerated that. We’re not really a first-time homebuyer market, but in 2020 prices surged and inventory went down, and in the last four years it’s held steady.”

“Let’s say that in Ithaca, in the northeast, a really desirable neighborhood, it’s not uncommon that multiple buyers are trying to bid on that house,” Warren explained. “Less inventory means higher prices, days on market have declined, and there’s also no new construction in our area.”

In other, bigger cities, new homes are being built. “We don’t have that in our area,” Warren said. “We need more construction, and we need more houses to sell.”

Barriers to construction in the region include infrastructure limitations (the need for expanded utilities, roads and public services can be a hurdle) and zoning and land-use regulations (zoning laws and land-use policies sometimes limit the availability of buildable land).

High development costs, including rising construction costs, labor shortages and supply chain disruptions, have increased the overall expense of building new homes.

Community opposition is also a factor, Warren said. Some proposed developments face resistance from locals’ concerns about density, traffic and preserving the character of existing neighborhoods.

For those who might have considered selling their home and purchasing a new one, an increase in the average interest rate on a mortgage can be a prohibitive factor.

“They don’t want to buy another house unless they really have a reason to move and get locked into a higher interest rate,” Warren said.

Prices for homes are going up. The ongoing inventory shortage has contributed to rising home prices. The average sale price in Tompkins County has surged 35% since 2020. In the past year alone, prices rose another 9%.

This trend is not unique to Tompkins County, Warren said. Neighboring counties are experiencing similar declines in available residential properties, with their combined average sales prices increasing by 41% to $209,700 since 2020. Over the past year, the region saw an additional 8% increase in home prices, according to MLS data for the counties of Cayuga, Chemung, Cortland, Schuyler, Seneca and Tioga.

Starting last year, one of the biggest shifts in real estate business practices has been the requirement for buyers to sign a Buyer Representation Agreement. This change, part of the National Association of Realtors (NAR) settlement, ensures clarity in the relationship between buyers and their agents. Buyers should expect to sign this agreement when working with a real estate professional.

“Now more than ever, it is crucial to work with an experienced agent backed by a trusted brokerage to navigate the complexities of today’s real estate market,” Warren said.

Recent assessment hikes across the county have led to concern from homeowners who have, as a result, seen a sharp increase in their property taxes. According to published reports, Jay Franklin, Tompkins County assessor, plans to put a freeze on assessments for most residential properties for at least 2025, and possibly longer, which Warren believes will be a positive thing for homeowners.

“It gives homeowners some predictability,” she said. In recent years, some homes were reassessed multiple times, significantly raising the homeowner’s property taxes.

“Your mortgage rate stays the same, but your taxes just doubled overnight,” Warren said. Many homeowners do not know that their home was reassessed, which she said can lead to confusion, though she added that all current property value assessments can be found on the Tompkins County Department of Assessment website, tompkinscountyny.gov/government-resources/assessment, where the 2025 preliminary assessment roll can currently be viewed.

Seaman’s advice for sellers is that they should invest some time and money into staging their home before putting it on the market. She suggests cleaning it with great attention to detail so it is “spotless” for potential buyers.

“You want your first impression to be good,” she said. “You get one shot.”

She has observed that, generally, people are not currently interested in fixer-uppers, and haven’t been for some time. They are much more likely to pay the asking price, or more, for a house that is completely move-in ready.

“Buyers are tired and fatigued and don’t want projects,” Seaman said. “In our society today, our most precious asset is time. And you can’t buy time.”