Newfield proposes $4.2 million budget with slight tax rate decrease

Newfield budget 2026 plans $4.2 million in spending with a slight tax rate decrease, maintaining town services and supporting key departments like highways and fire.

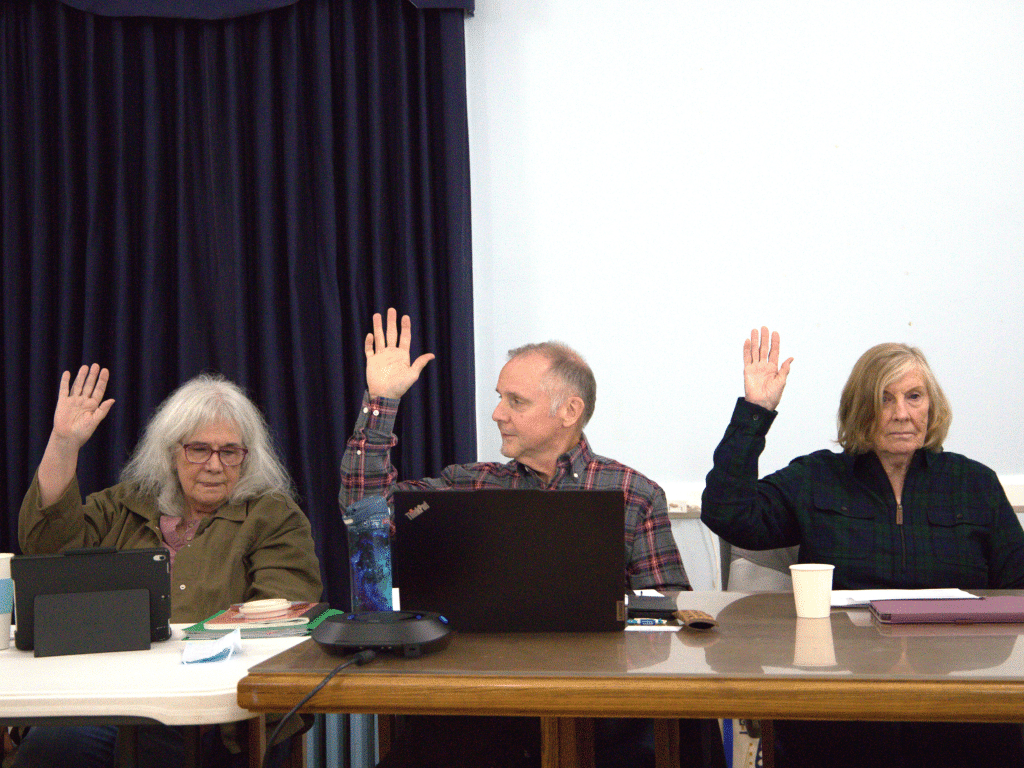

From left to right: Newfield Town Board members Joanne James, Town Supervisor Mike Allinger and Casey Powers vote to approve the town’s 2026 preliminary budget during their Oct. 9 meeting at the Masonic Temple.

Town of Newfield officials are proposing a $4.2 million budget for next year that will slightly lower the tax rate and fall under the state-imposed property tax cap.

The preliminary fiscal plan, which increases spending from this year by about $137,000, or 3.4%, was unanimously approved at the town board’s Oct. 9 meeting.

“It’s always a relief when you get the budget done every year,” Town Supervisor Mike Allinger said. “There’s not a whole lot of change in next year’s budget. We’re in the business of maintaining services.”

The budget would raise the tax levy, the amount of revenue the town generates from property taxes, to about $2.9 million — an increase of about $81,000, or about 2.9%.

However, the town’s property tax rate would decrease from about $6.33 to about $6.25 per $1,000 of assessed property value. The decreasing tax rate is partially due to increased property values.

The tax levy increase comes under the state property tax cap, which limits the annual growth of property taxes levied by local governments and school districts to 2% or the rate of inflation. However, taxing entities have calculated the tax cap to be above 2% in recent years due to the rising Consumer Price Index.

Last year, the town adopted its 2025 budget that included a 9% spike in spending and a 3% tax levy increase, which exceeded the state-recommended 2.86% tax cap for Newfield.

The tax cap is meant to provide property owners with more stability and relief in their tax bill, but Allinger said that inflation and rising costs for state-mandated employee benefits have made it harder for municipalities to fund essential services. Health insurance costs for town employees are set to increase by 18% next year, while the cost of state retirement benefits for employees will rise by 10-12%.

“New York state continues to hold us to this artificial tax cap, which really doesn’t benefit anybody anymore,” Allinger said, noting that the town normally passes a tax cap override every year to prepare for potential spending increases. “It serves no purpose in my mind anymore, except giving you a target to shoot for.”

About 69% of funding for the town’s “critical services,” including road maintenance, snow plowing, EMS and fire services, as well as youth programming, are paid for with property taxes, according to the preliminary budget document. The remaining funding comes from outside sources, including grant programs, fees for services and savings in the town’s appropriated fund balance accumulated over prior years.

About 44% of the proposed budget, including about $1.3 million of the tax levy, would go to the highway department. The funding would provide employees with a more than 3% salary increase, as well as additional dollars budgeted for brush and weed services. Just like this year, the highway department expects to receive another $400,000 in state-reimbursed Consolidated Local Street and Highway Improvement Program (CHIPS) funding next year, which will go toward road replacement projects.

The budget also allocates about 11% of funding for fire protection, with the majority of the fire department’s funds going toward equipment and training tools. The department initially asked for a 5.5% budget increase beginning next year but recently agreed to a 4.5% increase instead.

“Our fire department is awesome, and they’re volunteers,” said the town supervisor’s bookkeeper, Blixy Taetzsch. “Because of budget limitations, we didn’t feel that we could go to 5.5%, but that’s no reflection on the board’s feelings about the value of the service that the fire department provides to the community.”

Taetzsch added, “I think everyone understands that we’re all trying to do the best we can with what we have.”

Under the proposed budget, top town officials would receive 3% salary increases, including the supervisor (from $25,000 to about $25,800), the town clerk (from about $46,400 to about $47,700) and the highway superintendent (from about $86,600 to about $89,200).

The town’s general fund also includes $23,000 that would go toward software tools to improve the town’s website and social media platforms.

“We’re a pretty small town, so even little things like that make a big difference,” Taetzsch said, noting that one of the major planned changes is to move the town’s website from a .org to a .gov domain. “Our website is old, and I think it’s time for an upgrade to make things work more smoothly and make things easier to update in a way that people can easily find.”

The budget’s general fund also includes just over $48,000 in debt services related to the ongoing $1.4 million Town Hall renovation project, which town officials anticipate will be finished by the end of the year.

While essential services are receiving more funding, town leaders noted that youth programs are set to lose funding due to declining enrollment numbers. The town offers a summer camp program that’s open to up to 80 children, but Taetzsch said funding for its staff will be cut next year to serve 60 children instead, which is how many youth took advantage of the program this summer.

The Newfield Youth Commission, in partnership with Cornell Cooperative Extension, also offers a rural youth services program that includes after school and summer programs for students. Allinger said that the county should provide more funding to the youth commission to help sustain these programs, which he described as essential to Newfield youth.

“Kids need to have activities that will engage them,” he said. “Today, you need to have a two-income family, and a lot of these kids don’t have the support they need to keep them engaged and moving forward. If they’re happy with their community growing up, then that makes them more likely to stay in the community and raise their family here.”

Taetzsch also called on the county to contribute more funding to the town’s youth services.

“I think Newfield is a lower-income community,” she said. “We have folks with high needs, so the more we can do for them, the better, but the town and the school district can only do so much.”

A public hearing is scheduled for the budget at 7 p.m. on Thursday, Oct. 23 at the Masonic Temple, located at 186 Main St. Allinger said that the board plans to vote to adopt the budget at the meeting unless substantial changes are deemed necessary.

The town’s proposed budget can be found on its website, newfieldny.org.