Newfield supervisor responds to concerns of tax increase from solar project

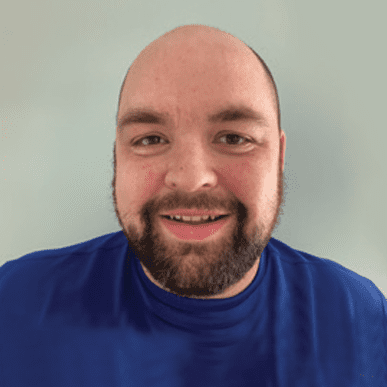

Town of Newfield Supervisor Mike Allinger spoke out recently regarding a TJA Clean Energy solar project proposed for Newfield. The project would not take land off the tax rolls, he said. The solar project would take place at this site on Elmira Road, which is off Millard Road.

Town of Newfield Supervisor Mike Allinger responded to concerns from residents of a possible increase in taxes if a proposed five-megawatt solar facility off Millard Hill Road is approved.

Allinger provided a message on the town’s website in response to residents who were voicing their concerns on the Newfield NY Community Facebook page:

“I’m writing [on Feb. 3] to clear up some bad information that has come to my attention. It was posted to the Newfield NY Community Facebook page that taxes would go up if a proposed solar project is approved in Newfield. In fact, it went on to say ‘If this project is approved every taxpayer in Newfield will be paying higher taxes for the next 25 years.’ This is based on the incorrect assumption that an approval of the solar project will remove land from the tax rolls. That is not the case. Approval of the project will not remove any property from the tax rolls.

“The post went on to accuse the town board of ‘trying to accomplish their personal agendas and not the needs of our community’ along with some other wild accusations. I won’t engage in disparaging anyone in a public forum but know this: the town board has one job and that is to work for the best of the Newfield Community. Full stop.”

TJA Clean Energy, based in New Bedford, Massachusetts, with a satellite office in Syracuse, proposed the solar farm in August.

The project, led by Michael Frateschi, president of TJA, will be a community solar farm spanning 25 to 30 acres. Frateschi noted that the proposed solar farm will share land with the current owners. According to Frateschi, the owners currently use more than 50 acres for farming.

Allinger, who recently spoke with the Tompkins County Assessor’s Office about payment in lieu of taxes (PILOT) agreements, explained how those agreements will line up with the proposed solar project in town.

“When a project like this gets payment in lieu of taxes, in their mind that would take it off the tax rolls,” Allinger said. “But the way a PILOT works is that in most cases it refers to the structure being built on top of the land, leaving the land underneath it still a taxable parcel.”

Developers from TJA first brought the PILOT agreement information to the attention of the town board, which Allinger confirmed with the county assessor.

Allinger noted that a lingering assumption throughout town was that if the land near Millard Hill Road came off the tax rolls, Newfield residents would carry that burden.

“But that is not the case,” Allinger said.

Allinger said the question of whether or not taxes will go up is “still a misguided statement.”

“There is no reason for everyone else to carry the tax burden of removing the land from the tax rolls,” Allinger said.

The notion prompted Allinger to provide an example of numbers to further explain how the process works:

“Let’s use a 2MW solar development as an example. A 2MW array would sit on a 10-acre lot. Agricultural land in Newfield is currently taxed around $50/acre … 10 acres x $50 = $500 tax for school, town and the county. The town sees about 20% of that, so the town would be out $100 from the tax rolls for that 10 acres.

“Enter the PILOT agreement. Currently, the IDA is writing PILOT agreements for $4300/MW so that would be $8,600 that is now collected on that same 10-acre parcel. So, 20% of the $8,600 is now $1,720 the town receives from the PILOT versus the $100 they would have received for just the ag land. So, I fail to see where anyone’s taxes would go up.”

Allinger also mentioned that the town’s planning board, the lead agency in terms of the New York State Environmental Quality Review (SEQR) for the proposed solar project, did work on the site plan review and “quite a considerable amount of work overall.”

However, based on local law, the town board is now the lead agency for the SEQR.

“The town board is taking up the task of SEQR now because it was brought to our attention by our developer, and our lawyer has concurred that our local law reads that the town board is responsible for large-scale solar projects when it comes down to a SEQR review,” Allinger said.

The town board has been working with Barton & Loguidice, a consulting firm in Syracuse, to guide interested agencies to recognize and accommodate that the lead agency will go from the planning board to the town board.

Allinger noted that the TJA developers are working to move the project forward. According to Frateschi, the goal is to begin project construction sometime this year.

“There’s some hurdles for the project to clear before the green light is given,” Allinger said.

As Allinger provides clarity on the tax situation, he notes that Newfield is a town with no zoning regulations.

“We’re a town that believes in the landowners’ right to do with their land as they see fit, as long as it doesn’t harm the environment and it follows the letter of the law,” Allinger said.

Newfield Notes appears every week in Tompkins Weekly. Send story ideas to editorial@vizellamedia.com.