Real estate seller’s market lessens but lingers; trend uncertain

Around this time last year, Tompkins County was seeing a very strong seller’s market in residential real estate, so much so that properties across the county would sell considerably above asking price and get sold within a matter of days (tinyurl.com/yapy2v36). As real estate agents explained, the county’s market today is still a strong seller’s market, but several factors have led to a significant lessening in its severity.

According to data from the Ithaca Board of Realtors (ithacarealtors.com/statistics/), as of July of this year, new listings in Ithaca were down 31.8%, pending sales decreased 9.2% and inventory shrank 9.4% since the same time in 2021. The median sales price increased by 16.2%, and the average length spent on market was 18 days, the same average in July 2021.

While that’s the macro view, real estate agents can attest that the story behind the statistics is complicated, to say the least. For one, pricing and time spent on market isn’t as consistent across the county this year compared to last, as Lindsay Hart, licensed real estate broker with the Hart & Homes Real Estate Team at RE/MAX In Motion in Ithaca (hartandhomes.com), explained.

“There are still pockets of areas where houses will just fly and get multiple offers,” Hart said. “And there are other areas where we will see a house sit for more than two [weeks]. … Also, we’re starting to see more offers come in with contingencies — so less cash, more mortgage, more structurals, more contingencies added to offers, and sellers are accepting them. So, it’s going in that direction slowly, basically back to what we would call normal.”

Diana Drucker, a certified buyer’s broker with Greenstreet Real Estate in Ithaca (realithaca.com), said that, for many buyers, the situation this year is worse than last, as she’s seen many sales in the county this year with no ceiling offers and no hard dates on when all offers will be considered.

“Someone lists the property and says, ‘I’ll be looking at all the offers Friday at noon,’” Drucker said. “You’re busy writing up an offer, and you see that it’s under contract, and it’s Wednesday. And you just call them up and you say, ‘Wait, weren’t offers on Friday?’ It’s like, ‘Well, we got an offer that was just too good not to take.’ … So, there’s that kind of stuff where you can’t compete when they’re coming in before the date and just scooping it up, or they’re saying, ‘I’ll pay any price.’”

As far as why the seller’s market continues to linger, sources across the board said it goes back to economy basics — low supply and high demand.

“There’s still quite a bit of demand — a lot of buyers want to buy — and we have absolutely no inventory,” said Brent Katzmann, associate broker at Warren Real Estate (warrenhomes.com). “We’ve got fewer than 200 active listings right now. We sold, year to date, about 775 residential properties in Tompkins County. Pre-pandemic, that number year to date would have been between 900 and 1,000. So, we are selling 15, 20, 25%, depending on the neighborhood, fewer properties.”

Hart said that the supply continuing to decrease has only made it more difficult for sellers to find a place to move to, perpetuating the problem.

“You have these homeowners that are looking to downsize and move around within the community, and they want to sell their home that they’re in now, because maybe it’s too big, or maybe they’ve outgrown it, but they have no place to go,” she said. “So, it’s this sort of cycle where we could get more houses on the market, there could be more inventory, but then those sellers, they don’t have a place to go. So, it’s like a catch-22.”

And as to why the severity of that seller’s market has decreased, most sources attributed that to fewer buyers due to a multitude of factors. Carol Bushberg, owner of Carol Bushberg Real Estate in Ithaca (carolbushberg.com), said that many buyers are feeling fatigued from the high-stress market of last year, leading them to turn to the renting market instead.

“A lot of the people who are looking for homes to purchase are tenants,” she said. “Well, if they have been unsuccessful … and many of our buyers have, they’ve tried multiple times to buy a property and been unsuccessful, … they have to make a decision about whether or not they extend their lease. And they really typically had to make that decision sometime between the 1st of June and the 15th of July. And so, we lose a lot of buyers by this time of the year.”

Kayla Lane, a licensed associate broker and property manager with Dryden Realty and Dryden Apartment Company (tompkinsliving.com), added that rising interest rates on things like mortgages also plays a role.

“That is proving to be a game-changer in our market,” she said. “But yet, [either] buyers are … waiting — maybe again, being more picky and choosy — [or] we could have less buyers out there now with the interest rates increasing or maybe their price points have changed. And our home sale prices haven’t adjusted yet.”

Fortunately, any pandemic-related challenges that lingered last year have mostly dissipated this year, with sources reporting more in-person tours and fewer safety concerns. However, there are still significant challenges related to the staffing and supply shortages affecting a wide swath of industries.

“We’re particularly seeing it with closings, once you get things under contract, where we have a real shortage of surveyors, and they’re as busy as can be,” said Kristopher Buchan, principal broker and owner of Tompkins Cortland Real Estate, LLC (tompkinscortlandrealestate.com). “And then, there have been some staffing issues with some of the abstract companies; they can only go so fast, and they have such a backlog because for a while with COVID restrictions, they used small offices, and they couldn’t have everybody at work. So, honestly, the biggest challenge, I think, with real estate right now is actually getting things closed, just because it’s taking a while.”

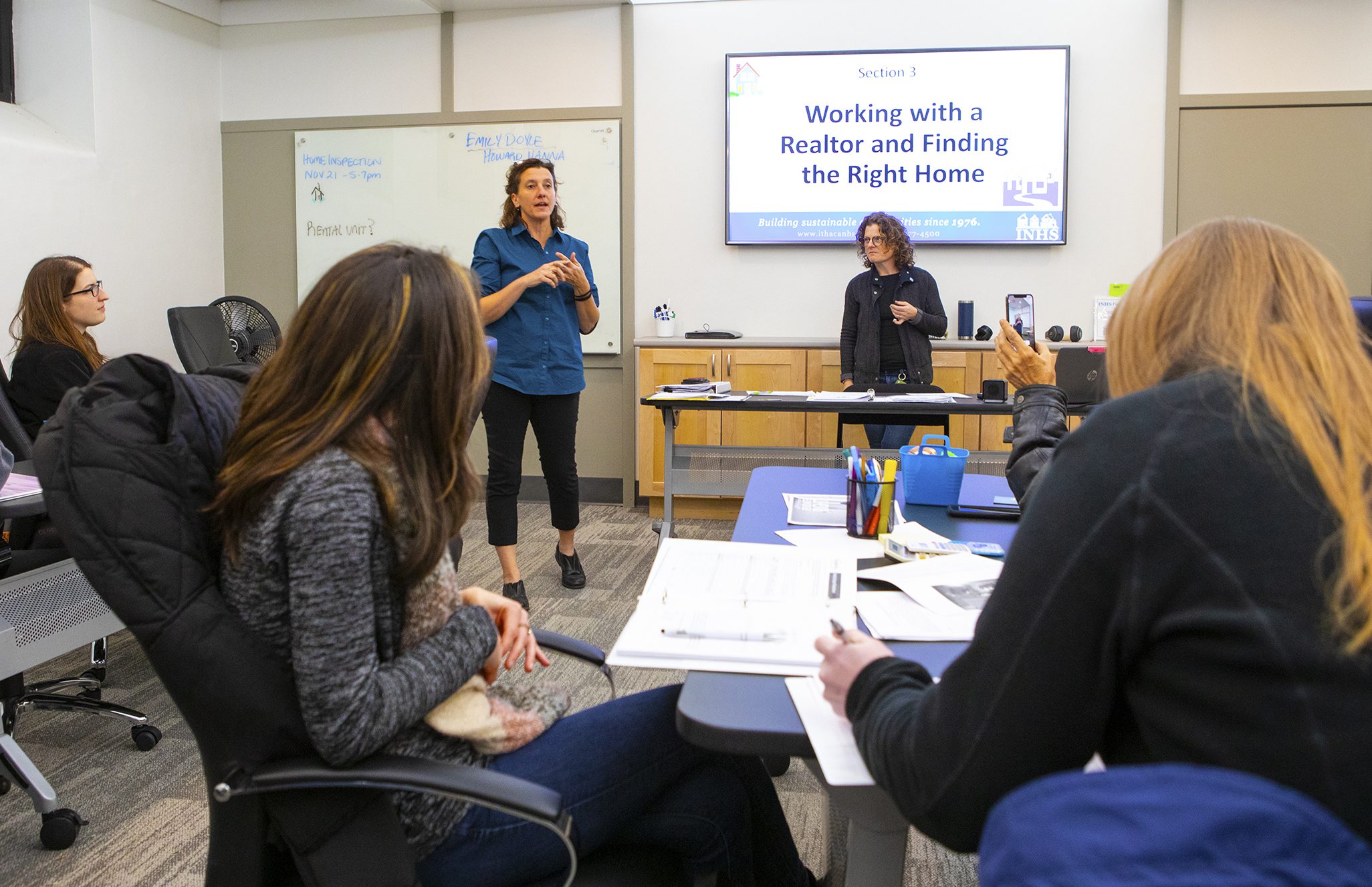

Ann DiPetta, Homebuyer Education consultant with Ithaca Neighborhood Housing Services (INHS, ithacanhs.org), explained that, in her experience educating homebuyers this year, the long wait times on things like renovation materials has had a noticeable impact on the kinds of properties buyers are looking for. Still, most contractors are well aware of these delays and try to help as much as they can in emergency situations.

“A lot of the contractors that we work with and talk to are generally open to hearing the urgency of the matter,” she said. “So, I think most of them are like, ‘OK, if there’s an active leak, I’m going to help you with a stopgap measure until I can actually come and redo the whole thing.’ I think most of the contractors that are in business and are out there doing the work want to help people that are in an emergency situation, even if they can’t get to the whole project.”

Looking ahead, sources varied as to how long and to what severity the county’s seller’s market will continue in the coming years.

“There is not a ton of new development or new construction,” Drucker said. “There’s apartment buildings being built, [but] … I don’t think building more rentals is going to really trickle down and make a difference in selling. And yeah, I see it as still a seller’s market. I think that there are still people who are coming here because we are in that little safety bubble of we don’t have wildfires, earthquakes, tornadoes.”

While all sources emphasize that the situation is far from the housing bubble the nation saw over a decade ago, some, like Lane, are still keeping an eye out for “a crash of some kind.”

“I’m more anxious of how quickly things are going to change in the market because of how much the interest rates have increased,” she said. “I don’t see it being a huge housing crisis or bubble as we’d once experienced. But it will be interesting to see if it changes the dynamic of our market, and maybe it does become more of a buyer’s market by next year.”

In the meantime, sources provided some advice for homebuyers in a market that remains challenging to navigate. DiPetta, for example, said it’s important for first-time homebuyers to get “their ducks in a row” before diving into their first home purchase. Bushberg seconded that sentiment, adding that she and agencies like hers are always willing to help a buyer with that process.

“Before I bring someone into your house to show them your house and unlock your doors and have a stranger in your house, I want to make sure that that stranger has the ability to buy your house from a financial perspective,” she said. “And so, we assist people in partnering with local lenders and different kinds of lenders … and working with that lender to get a good idea of whether or not they’re actually ready to move forward to buy a house.”

For more information about the agencies mentioned in this article, visit their respective websites.

Jessica Wickham is the managing editor of Tompkins Weekly. Send story ideas to them at editorial@VizellaMedia.com.

Publisher’s note: We’ve appreciated inputs from readers on recent Tompkins Weekly coverage of the Reimagining Public Safety initiative. As always, those with thoughts or feedback on this or other community topics are encouraged to email editorial@VizellaMedia.com or call (607) 533-0057 weekdays during business hours. Thank you for supporting local journalism in Tompkins Weekly. Todd Mallinson, Publisher.