Tax season is here, Lansing residents are paying higher property tax than last year

Lansing Town Supervisor Ed LaVigne said that a decision to raise town property taxes is never one he takes lightly, but the past year has left the town with few options.

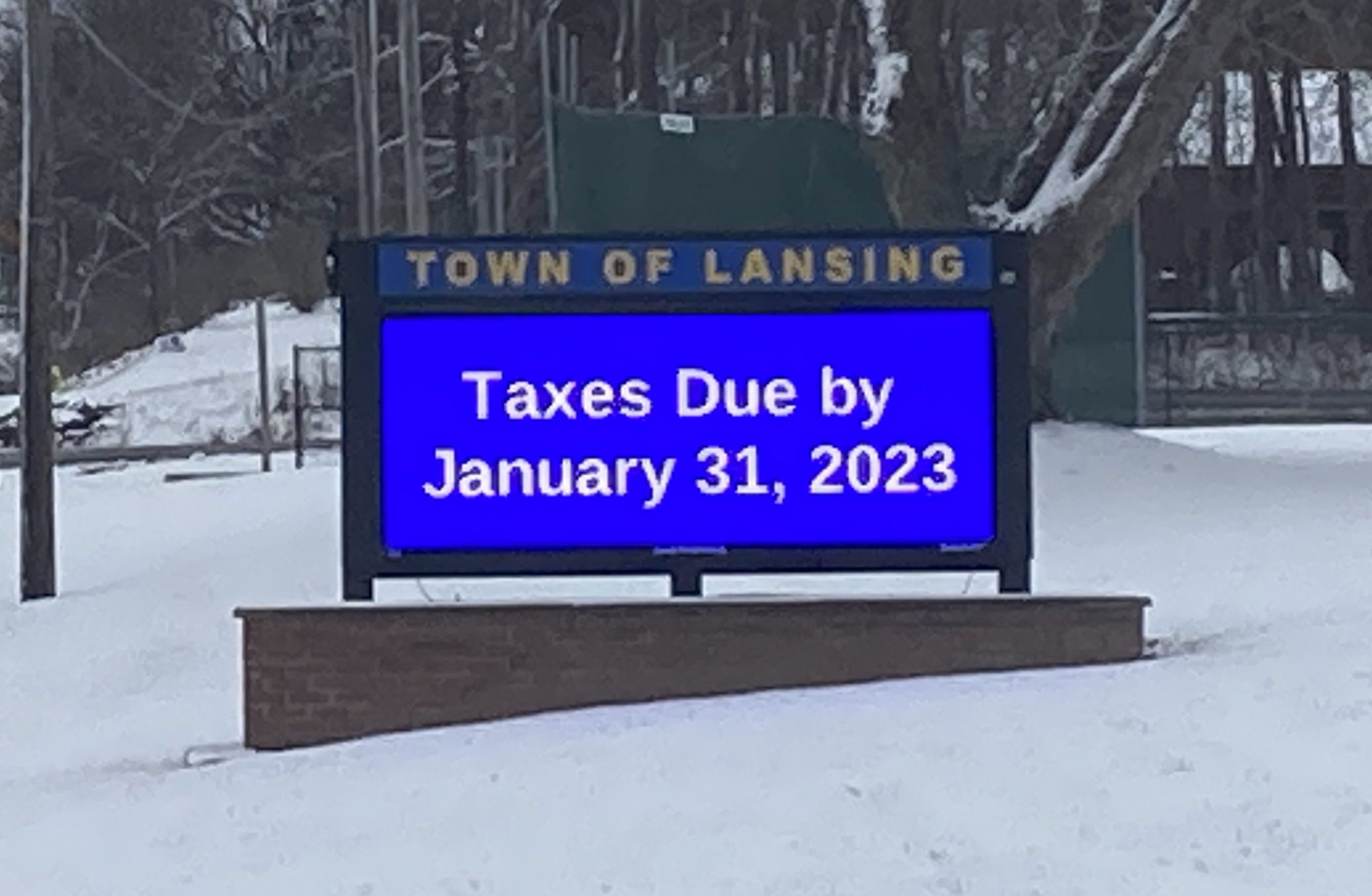

As January comes to a close and property owners prepare to pay their taxes, they will be paying a higher rate than they did last year.

Last year the town board approved an increase of 20 cents per every $1,000 of assessed property value. During the last tax season, property owners paid $1.57 per every $1,000; this year, they will pay $1.77.

Lansing at Large by Geoff Preston

If a property is assessed at $100,000, it would be taxed $177. LaVigne said that the average Lansing property is assessed between $300,000 and $400,000, meaning a town tax bill between $531 and $708.

The 20 cent increase means that someone with a $400,000 assessment on their property would pay $80 more in taxes this year compared to last year.

LaVigne said he understands that residents are frustrated, especially with having to pay taxes to four other entities. He said any increase in taxes is difficult.

“I didn’t joyfully put that through, and I wouldn’t say, ‘It’s only [20 cents],’ because it’s their money, it’s hard earned,” he said.

Rising costs and continuing recovery from the COVID-19 pandemic weren’t the only factors, according to LaVigne, but he said that neither made things easier.

Lansing has money set aside that LaVigne referred to as Fund Balance. He described this as enough money to help the government run for three to six months in the case of an emergency or exceptional circumstance.

He said the pandemic was viewed as an exceptional circumstance, so for the last couple of years the town has spent enough of that money that the fund is below its three-month threshold. The town government needs to get that fund back above the three-month standard, while not cutting back on staff and services the town relies on.

During the pandemic, that Fund Balance money was used for costs that American Rescue Plan Act (ARPA) funds would not cover, LaVigne said, as ARPA funds are designed to be used for capital improvement projects.

In addition, LaVigne said that inflation has driven up the costs of goods that the town needs to provide essential services.

“This last time around, the pandemic was a part of it, the prices went up. We did a lot of budget modifications because the price of fuel, the price of salt, price of materials for the marina, the prices for everything went up,” he said. “It killed me to do it, I hated it, but it was a last resort. No one likes to have their taxes raised, I get that. But you have the prices of everything going up, and you don’t know when it’s going to stop.”

With the Fund Balance amount going down and prices going up, LaVigne said he thought the increase was the best course of action.

“We could cut staff and we could cut services, but I don’t think that would be appropriate. I think the best way to do this is to keep the value of your [town property tax],” he said. “I understand people’s frustrations with this, with inflation and everything else going on, but unfortunately we’re not immune to inflation either. It’s brutal. We’ll do the best we can and still provide excellent values, keep the roads clean, safe, keep our rec

Tax season is here, residents are paying higher property tax than last year

department going, all of our different programs going and all the things people expect.”

LaVigne said that the town’s property tax makes up about 6% of total tax liability a resident will face. They also pay county, school, fire and protection and library taxes. Some residents may face additional trash collection taxes or special water district taxes.

Many things throughout a year impact the tax rate for the next year. LaVigne remembered 1993, when the region was hit with multiple snowstorms and the town’s highway department was working nonstop. He also recalled when the U.S. housing crisis and subsequent recession forced municipalities to make difficult decisions.

He said the pandemic has had a similar effect on town finances, but it wasn’t the only reason for the tax increase. He called it a perfect storm of the pandemic, inflation, lack of business tax revenue and the costs of some capital works projects like the Bulkhead Wall Marina project.

The town has been through difficult situations before, and LaVigne said that while he hated to increase taxes, he’s confident that Lansing will be in a better place and will be able to see an eventual decrease in the property tax rate.

“I’m not blaming it all on the pandemic. We’ve been through inflation before and we’ve been through recessions before, and we go from there,” he said. “Somebody had to make the hard decision. This is what the hard decision was, and I’ll take full responsibility for that. At the end of the day, if the town is financially stronger and safer, okay, then maybe it was the right decision. I personally think it was.”

LaVigne also mentioned that the town sets the rate well before tax season, and the public is invited to participate through public meetings and discussions throughout the year.

He said the board welcomes those discussions and conversations.

“I understand, some people have sticker shock. We do also have public hearings on these [issues],” he said. “Sometimes, people find out ahead of time and they come to participate. Other times, they wait for the bill, but they can ask questions anytime. I’d be happy to talk to anyone about this anytime.”

Lansing at Large appears every week in Tompkins Weekly. Send story ideas to Editorial@VizellaMedia.com