When the rain came in

Trumansburg Flood Risk affects families like the Becks. Learn about new FEMA maps and insurance needs in 2025!

Trumansburg family’s flood story highlights growing risks as new flood maps force insurance requirements

P.J. Beck of Trumansburg remembers the afternoon well. She was at work, and her wife, Casey Beck, was at home.

“It wasn’t raining where I was, but there was a huge black cloud over Trumansburg,” P.J. said.

On May 15, a rainstorm hit Trumansburg at a force the couple had not experienced since moving into their home on Halsey Street with their two children eight years ago.

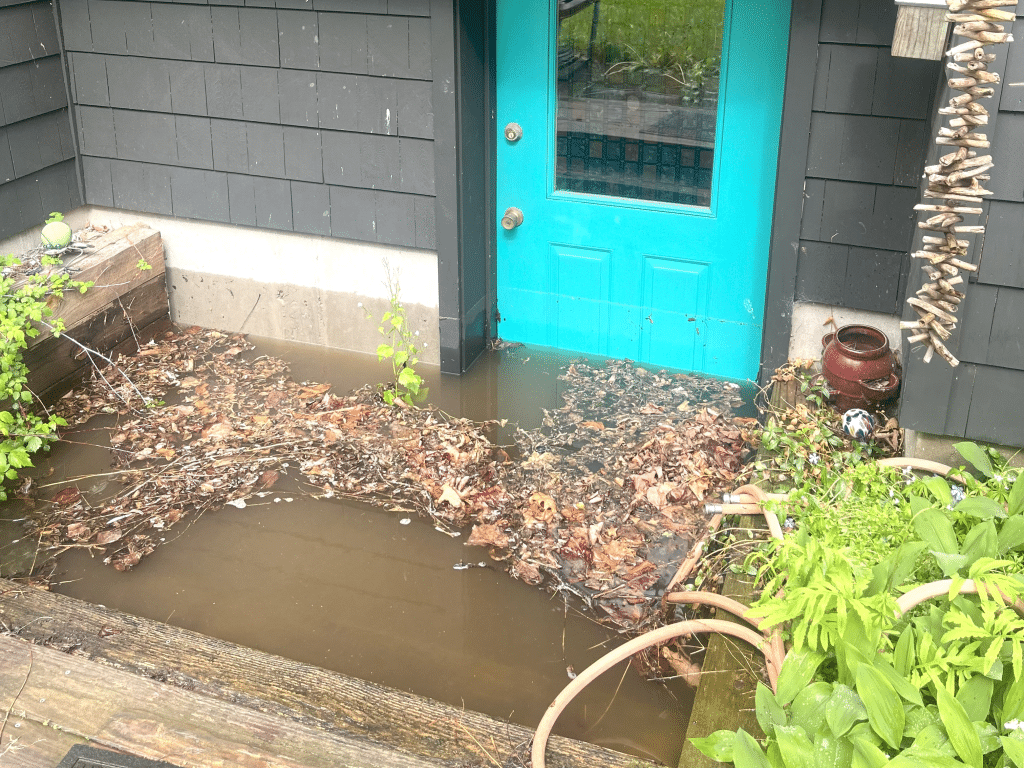

An outdoor stairwell leading to a basement side door completely filled to the brim with about three feet of water, causing it to gush through the door at an alarming speed.

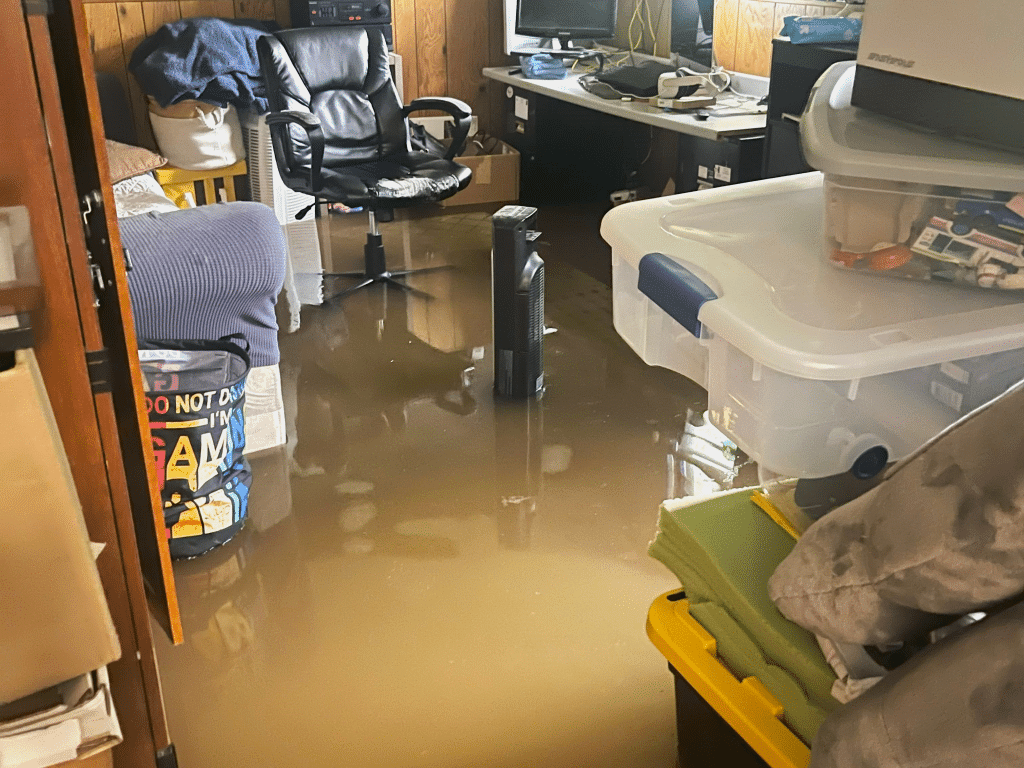

In a panic, Casey texted P.J. cell phone videos of water pouring through the door and flooding the family’s entire finished basement. Before they knew it, 8 inches of water had destroyed everything on the floor, including carpets, a couch and other belongings stored in the guest room and the kids’ gaming room.

They saw a Trumansburg fire truck heading to another home that they assumed was likely flooded as well, which gave them the idea to call the department for help. In a short time, firefighters arrived and used fire hoses to pump the water out of the basement.

After what they experienced in their home, P.J. will never think of rain the same way again.

“The first night we moved in, there was a rainstorm and we didn’t have anything unpacked, and we laid in our living room, and there’s skylights, and boys were 3 or 4, and we watched the rain and it was so beautiful,” she said. “I used to love rainstorms, and thunder and lightning, and now it gives me anxiety.”

Tompkins County at increased risk

“I think that Ithaca is a difficult place to own a home because the city is built on top of a swamp, so these water issues are inherent to where we live,” said Steven Schapiro, New York State Licensed Real Estate Broker and owner of CSP Management, an Ithaca company that specializes in managing properties — including places it owns and other properties in need of management services.

“It’s not necessarily that flooding is occurring for people now for the first time,” Schapiro said. “It’s that there’s an uptick in how often it occurs.”

Until the May flood, the Becks had only experienced flooding in the basement one time when they first moved in and discovered one of the sump pumps was not working properly.

The increased risk of flooding is reflected in new changes to the 100-year floodplain maps recently released by the Federal Emergency Management Agency (FEMA).

“Just in the city [of Ithaca] alone, we had 600 additional properties mapped into the special flood hazard area,” Lisa Nicholas, City of Ithaca director of planning and development, said at an informational meeting about flooding hosted by the City of Ithaca on July 14.

Some of the additional risk is due to changing infrastructure, said Abigail Conner, environmental planner in the Tompkins County Department of Planning.

“Our maps previous to this were from the 1980s, so it’s been about 40 years,” Conner said. “A lot has changed. There’s a lot more impervious surface.”

She added that Tompkins County itself is “a little bit of a bowl.”

At the July 14 informational session, which focused on flood maps and insurance, Val VanGorder, vice president of Bailey Place Insurance, provided a laundry list of recent flooding events.

Just the day before the meeting, she said, there was flooding in New York City and, much closer to Tompkins County, in Newark Valley. Six New York counties were under flood watch the evening of June 6, and before that there was a flood watch in Tompkins County in May. In August 2024, there was a flood watch in Tompkins County as remnants of Hurricane Debby brought heavy rain to the area. In October 2021, streets flooded in Ithaca, and parts of Fall Creek reached the highest levels of water seen in that neighborhood in many years.

“Here in Tompkins County and Cortland County, we see flooding all the time,” VanGorder said. “It seems like every other day we’re getting flood warnings on the news.”

Remapping the floodplains of Tompkins County

Sam Quinn-Jacobs, from the City of Ithaca Department of Planning and Development, said at the Ithaca meeting that new technologies led FEMA to remap communities, including, recently, Tompkins County.

The term “100-year floodplain” can be known as a few different things, he said. It can be called “Zone AE.” It can be called a “high-risk zone,” and it’s also known as the “special flood hazard area.”

FEMA has made the flood maps available in several ways, including in a searchable address index where property owners can type in their address and receive a PDF of their area. There is also a more detailed map online where people can find their property by searching for the address. It can be accessed by Googling “national flood hazard layer viewer” and clicking on the first result.

Homeowners who have a mortgage from a federally regulated lender for a property located in Zone AE can expect to receive a letter stating that they are required to have flood insurance.

A Floodplain Development Permit is often required for properties located within the Special Flood Hazard Area, or Zone AE. This means that any new construction or major renovations or additions must comply with local flood damage prevention ordinances.

“They may have to be elevated, or utilities may have to be elevated on new construction,” Quinn-Jacobs said.

Those who believe they have been improperly mapped and that their property should not be classified as a high flood risk may challenge the classification of their home by contacting their local floodplain administrator.

For the city of Ithaca, that individual is Nicholas.

“But, we kind of share the responsibility in the planning department,” Quinn-Jacobs said.

For other towns and villages, Quinn-Jacobs recommended contacting the municipality’s planning department or code enforcement officer.

“They’ll know who the flood plan administrator is,” he said.

On the Tompkins County website, tompkinscountyny.gov, there is flood information in the “government resources” tab, said Connor. The webpage has several videos that walk homeowners through how to obtain flood insurance, the factors that determine the price of insurance, and how to file a claim.

Insurance ramifications

All of Tompkins County has been designated a flood zone, but certain areas have been deemed to carry a higher risk.

New flood insurance rate maps take into account the elevation of a property’s foundation, its proximity to water and numerous other factors to determine what the premium will be for flood insurance.

Once a homeowner receives a letter stating that they must purchase flood insurance, they have 45 days to obtain a policy. Those who do not comply can expect their insurance company to “force place” a policy, VanGorder said.

Flood insurance is available in Tompkins County through the National Flood Insurance Program (NFIP), a federally underwritten program. The NFIP provides flood insurance in more than 22,000 communities across the nation that have agreed to adopt and enforce sound floodplain management regulations, according to the city of Ithaca’s website.

VanGorder has found that sometimes NFIP insurance is less expensive than insurance through private companies, and other times it costs more.

“We have seen [private company] premiums 10% to 50% less than the National Flood Insurance Program, but not always,” she said. “The other day I did flood quotes, and the National Flood Insurance program, those quotes were less than all the private companies that we looked at. So we just never know.”

As of March 2025, $898 is the national average annual cost for a flood insurance policy from the federally backed National Flood Insurance Program, or NFIP, up 3.2 percent from October 2024, according to Bankrate.

“There are minimum insurance requirements, and it’s either going to be the outstanding loan balance that you have or the replacement cost on your property. That’s going to be up to a bank – your lending institution – to decide,” VanGorder said.

The maximum amount of insurance coverage that may be taken out and that the NFIP can require is $250,000 maximum for residential properties and $500,000 maximum for commercial, VanGorder added.

Premiums can be subject to change.

“Say you have a $200,000 loan and two years later it’s down to $180,000,” she said as an example. “We can look to lower your coverage to $180,000 to get your premium down some.”

Most people want to go with a high deductible, and most banks will only allow policies with a deductible of $5,000, she added.

“[Some banks] do offer up to $10,000,” she said. “Most banks won’t let you go more than $5,000.”

Insurance will pay claims for repeated flood events at the property, VanGorder said, “but your rate will definitely go up.”

The Becks did not have flood insurance, and P.J. was surprised to find that flooding was not covered under her regular homeowner’s insurance.“Water coming in from outside generally is not covered,” was the simple rule that was explained to her by the insurance company.

“If a tree were to bust the roof and rain came in, that would be a different situation,” said P.J.

Burst frozen pipes would have also been covered, she said.

“Water coming in from outside is a really important piece [of protection],” P.J. said, “and shame on me, because I assumed that would be covered.”

Preventative measures

There are ways people can protect their properties from flooding issues. Schapiro offered a few suggestions, including:

-Improving the grading of the property is often the most effective way to make a big change.

-Install a trench system with French drains, slightly sloped trenches filled with round gravel and a pipe that divert water away from the house’s foundation.

-Raising appliances or putting them on cinderblocks reduces the chance that they will be damaged if flooding occurs.

-Installing a sump pump, a common device used to remove water that has accumulated in a water-collecting sump basin can be very effective. Schapiro reminded homeowners who have one to make sure that the pump’s battery is active.

–Check gutters to make sure they are clean and that the downspouts are directing water at least six feet away from the building’s foundation.

During the flood

In the case that a house is flooding, the homeowner should immediately turn off the electricity using the main breaker box, Schapiro said, and leave the home entirely if it doesn’t feel safe to stay there.

If there is a substantial amount of standing water, the local fire department can help pump the water out, but will not be able to suck up the last inch or so of water. This is something the Becks experienced firsthand.

“Once it was down to a certain level, the rest we had to get rid of with a push broom and a wet-vac,” P.J. said. “We’d have to fill the wet-vac, and then have to move it and dump it, meanwhile pulling everything out that was wet and soaked and heavy, and pulling that onto the lawn.”

What to do in the aftermath

After flooding occurs, the main goal is to get air flowing through the home, Schapiro said.

Cut out any drywall that has been soaked through.

“It only takes 48 hours for mold to grow,” Schapiro said. “The sooner you can get it out, the better.”

P.J. said her family hired a professional company to help out, and one of the first things they did was remove the baseboards and drill holes in the lower part of the drywall to allow the air to flow through and dry it out.

The Becks rented a large dumpster, and it was filled by the time they removed all the unsalvageable, soaked items.

P.J. said that, through her conversations with professionals throughout the ordeal, she has come to find out that the best long-term solution will likely be to regrade the yard. At this point, though, the family is still too busy dealing with the damage to consider a major excavation of their lawn.

For now, they have purchased several additional movable flood barriers to add to the few they already had before the flood. They look like a sock filled with absorbent material and act like small dams, P.J. said, and they seem to be effective at blocking the flow of water to the foundation of their home.

She said her family is moving forward and viewing the experience as a teachable moment. The couple explained to their 11-year-old sons that their family is lucky to have a dry living space to retreat to where they can sleep and feel safe.

“Not everybody has that,” P.J. said. “It’s important to keep that perspective.”

To learn more about flood insurance, visit the NFIP websites at https://www.fema.gov/flood-insurance and http://www.floodsmart.gov.